Rising interest rates, a shortage of available inventory, and issues with affordability have put tremendous pressure on the U.S. housing market in recent years, affecting both buyers and sellers. The implementation of portable mortgages, a policy that former President Donald Trump and federal housing officials have indicated interest in investigating, is one of the most talked-about concepts that has recently gained traction.

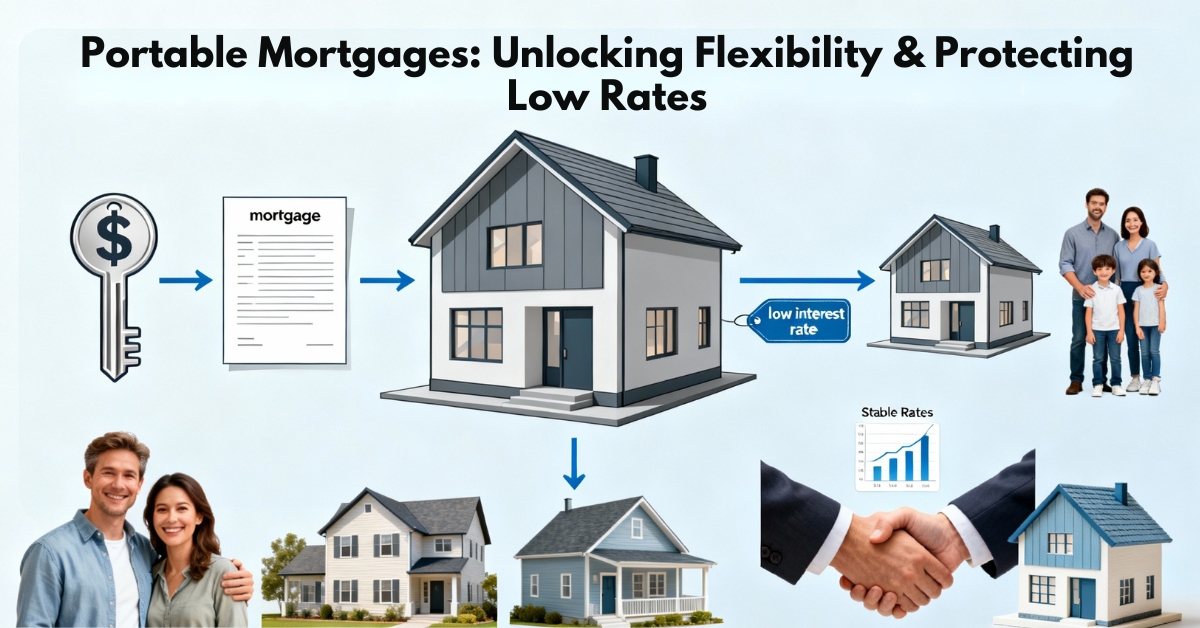

Homeowners may be able to move their current mortgage, together with its terms and interest rate, to a new residence if portable mortgages are put into place. At a time when millions of homeowners feel “locked in” to low rates and unable to move without taking out a much more expensive loan, this could be a significant change in the way American mortgages operate.

We explain what portable mortgages are, how they would operate, why they are being considered, and what they might mean for homebuyers and the housing market as a whole in this comprehensive blog.

What Are Portable Mortgages?

A home loan that can be transferred from one property to another is called a portable mortgage. When you sell your house, you would take your current mortgage—with the same terms, balance, and rate—and apply it to your next home rather than paying it off.

While they are already available in some nations, like Canada and the UK, portable mortgages would be brand-new in the US. In the U.S., most mortgages are not portable because loans are tied to a specific property as collateral. Modifications to the mortgage-backed securities market and regulatory changes would be necessary to alter that structure.

Still, the core idea is simple:

- You keep your low interest rate

- You avoid paying closing costs for a new loan

- You gain the ability to move without financial penalty

In an era of high mortgage rates, this could be a game-changer.

Why the Trump Administration Is Exploring Portable Mortgages

Currently, mortgages with interest rates below 4% are held by more than 60% of American homeowners. During the pandemic, when borrowing costs were at all-time lows, many locked in these historically low rates. With mortgage rates currently ranging from 6 to 7%, a homeowner’s monthly payment could double if they move to a new residence.

Experts refer to this as the “mortgage lock-in effect.” Because they don’t want to forfeit their low-interest mortgage, homeowners are reluctant to sell. Consequently:

- Fewer homes are listed for sale

- Housing inventory remains tight

- Prices stay elevated

- Mobility and job relocation become harder

Because they could break this lock-in and enable homeowners to relocate without having to deal with significantly higher mortgage payments, portable mortgages are being investigated as a potential remedy.

How a Portable Mortgage Would Work

The general concept of a U.S. policy would probably have the following structure, even though the specifics are still being worked out:

1. Transfer Your Mortgage Rate

If you have a 3% mortgage today, you could keep that same 3% rate on your next home.

2. Carry Over the Remaining Balance

If you still owe $250,000, that balance would transfer to the new home’s mortgage.

3. Borrow Additional Funds if Needed

You may be able to obtain a supplemental loan at the current market rate if the cost of the new home is higher.

In nations where mortgage portability is already in place, this hybrid strategy is typical.

4. Continue With the Same Terms

Your repayment schedule, fixed-rate terms, and other conditions would stay the same.

5. Undergo Standard Qualification

To make sure the borrower can afford the new home, lenders would still check income, credit, and debt ratios even with portability.

Potential Benefits of Portable Mortgages

If implemented effectively, portable mortgages could unlock major advantages for homeowners and the broader housing economy.

1. Preserving Low Mortgage Rates

The main attraction is this.

Maintaining a rate that may be much lower than the current market average is advantageous to homeowners.

2. Increased Flexibility for Families

Portable mortgages would make it easier to:

- Move for a new job

- Upsize for a growing family

- Downsize in retirement

- Relocate for lifestyle changes

Without the fear of losing a low mortgage rate, homeowners regain mobility.

3. Boosting Housing Inventory

One of the main causes of high home prices is a lack of inventory.

More homes will enter the market and help stabilize prices over time if portable mortgages encourage more owners to sell.

4. Lower Monthly Payments on New Homes

Compared to taking out a new mortgage at today’s rates, buyers could save hundreds or even thousands of dollars a month because the current mortgage rate carries over.

5. More Predictable Financial Planning

Without having to worry about fluctuating interest rates, homeowners could make long-term housing decisions.

Potential Drawbacks and Challenges

Although portable mortgages seem like a good idea, there are several obstacles to overcome before they can be used in the US system.

1. Mortgage-Backed Securities (MBS) Complications

The majority of mortgages in the United States are packaged and offered as securities to investors. These investors anticipate specific payback schedules.

Portable mortgages have the potential to lengthen loan terms, which would be unpredictable and upend current models.

2. Possible Higher Upfront Rates

Lenders and investors might demand higher interest rates on new mortgages to offset future uncertainty, which could have an effect on affordability.

3. Legal and Structural Challenges

Mortgage contracts in the United States are currently linked to a particular property. It would be necessary to amend regulations and perhaps enact new laws in order to redesign the system to accommodate portability.

4. Limited Benefit for New Buyers

Since they don’t have an existing mortgage to bring with them, renters and first-time buyers won’t profit from portability.

5. Potential for Market Distortion

Focusing on portability, according to some experts, could divert attention from the main problem, which is that the United States is just not producing enough homes.

Supply shortages cannot be resolved by portable mortgages alone.

How Portable Mortgages Could Impact Homeowners

For homeowners with low-rate mortgages, this policy could be transformative. Consider these scenarios:

Scenario 1: A Young Family Upsizing

A family that wants more space but is afraid of doubling their mortgage rate has a 2.75% mortgage.

They can relocate without compromising affordability thanks to portability.

Scenario 2: A Worker Relocating for a Job

When workers are not hindered by housing, job mobility improves.

The financial strain of moving might be lessened with portable mortgages.

Scenario 3: Retirees Downsizing

Because moving could result in higher payments, older homeowners might remain in their current residence longer.

Retirees can be flexible without worrying about money thanks to portability.

Scenario 4: First-Time Sellers Entering the Market

The number of available homes for others may increase if homeowners who purchased during low-rate years finally feel comfortable selling.

Could Portable Mortgages Improve Housing Affordability?

The answer is: partially.

Current homeowners, not first-time buyers, are the primary beneficiaries of portable mortgages. Portability isn’t a panacea, but more inventory might subtly aid in price stabilization.

The affordability of housing is also influenced by:

- New construction

- Zoning policies

- Wage growth

- Supply chain availability

- Mortgage rate trends

Still, the policy could ease pressure in the short term and improve market mobility—both of which matter.

Will Portable Mortgages Become a Reality?

The idea is still under evaluation, and implementation would require coordination among:

- The Federal Housing Finance Agency (FHFA)

- Fannie Mae and Freddie Mac

- Mortgage lenders

- Lawmakers

- Investors in mortgage-backed securities

The intricacy of portable mortgages may cause them to develop slowly, if at all.

Nonetheless, the fact that they are being openly discussed demonstrates how urgently decision-makers are looking for creative solutions to alleviate the present housing crisis.

Final Thoughts

Concluding remarks

A daring and fascinating concept, portable mortgages have the potential to significantly increase homeowner flexibility and open up the stagnant housing market. The policy might lessen the lock-in effect, improve housing mobility, and provide families more flexibility to relocate without incurring financial penalties by permitting borrowers to take their low-rate mortgages with them.

Even though there are still obstacles to overcome, particularly in the areas of implementation and investor concerns, the discussion itself shows a growing understanding that the conventional mortgage system might require modernization.

Portable mortgages could be one of the biggest housing reforms in decades if lawmakers can resolve the structural problems. They would give homeowners security, stability, and newfound flexibility in a volatile market.